Changes as of 2023

Deposit protection is changing from 1 January 2023 for account balances held at banks. In the event of a bank’s bankruptcy, the deposit insurance scheme protects client deposits against loss up to the amount of CHF 100 000. These are the most important legal changes that will apply from 1 January 2023:

What is changing for joint accounts?

- If several persons own an account together, this group is treated as an individual, separate client when it comes to protection.

- If this group holds multiple accounts, these are added together.

- The balance for the group is protected up to a total of CHF 100 000.

- As an example, groups might comprise spouses, simple partnerships, communities of heirs or condominium associations.

- If individuals in such a group have their own separate client relationship with the bank, a balance of up to CHF 100 000 is also protected for this separate client relationship.

Until 31 December 2022, the group’s balance is divided among the individuals in the group, the split amount then added together with claims from individuals’ own separate client relationship and the protection capped at CHF 100 000 per person.

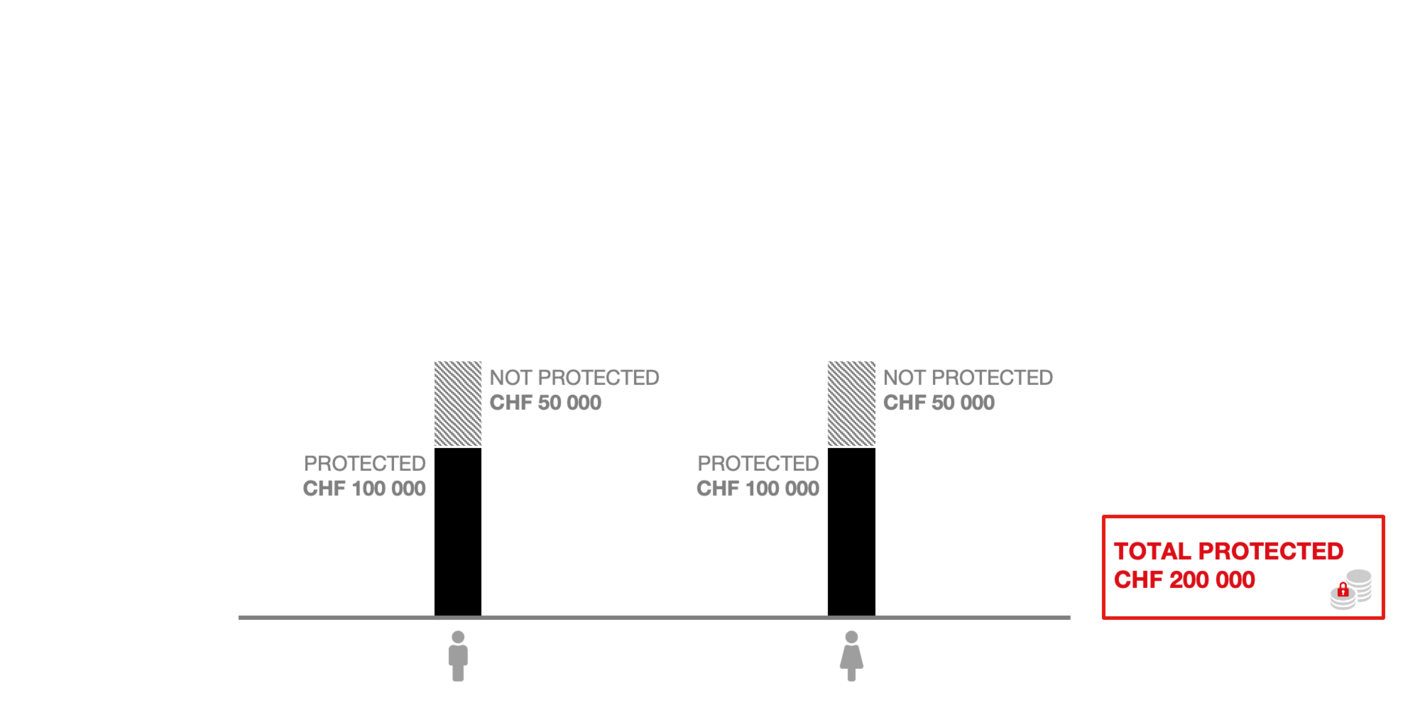

Example 1 - Joint account only

Until 31.12.2022: division of the joint account

In the past, the balance on the joint account was divided equally between the two spouses to determine the amount of the protected deposit.

Until 31.12.2022: guarantee of deposits in the event of a bank’s bankruptcy

These two parts were then each limited to a maximum of CHF 100 000 per person in each case. The community had no claim of its own. The spouses therefore had a protected deposit of CHF 200 000 in total.

As of 01.01.2023: guarantee of deposits in the event of a bank’s bankruptcy

As of 1 January 2023, the community of spouses now forms its own separate depositor. Their joint account will no longer be divided, but the joint account will be protected with a maximum of CHF 100 000.

In this example, the protected amount is reduced from CHF 200 000 to CHF 100 000.

Example 2 - Joint account and two personal accounts

Joint account and two personal accounts

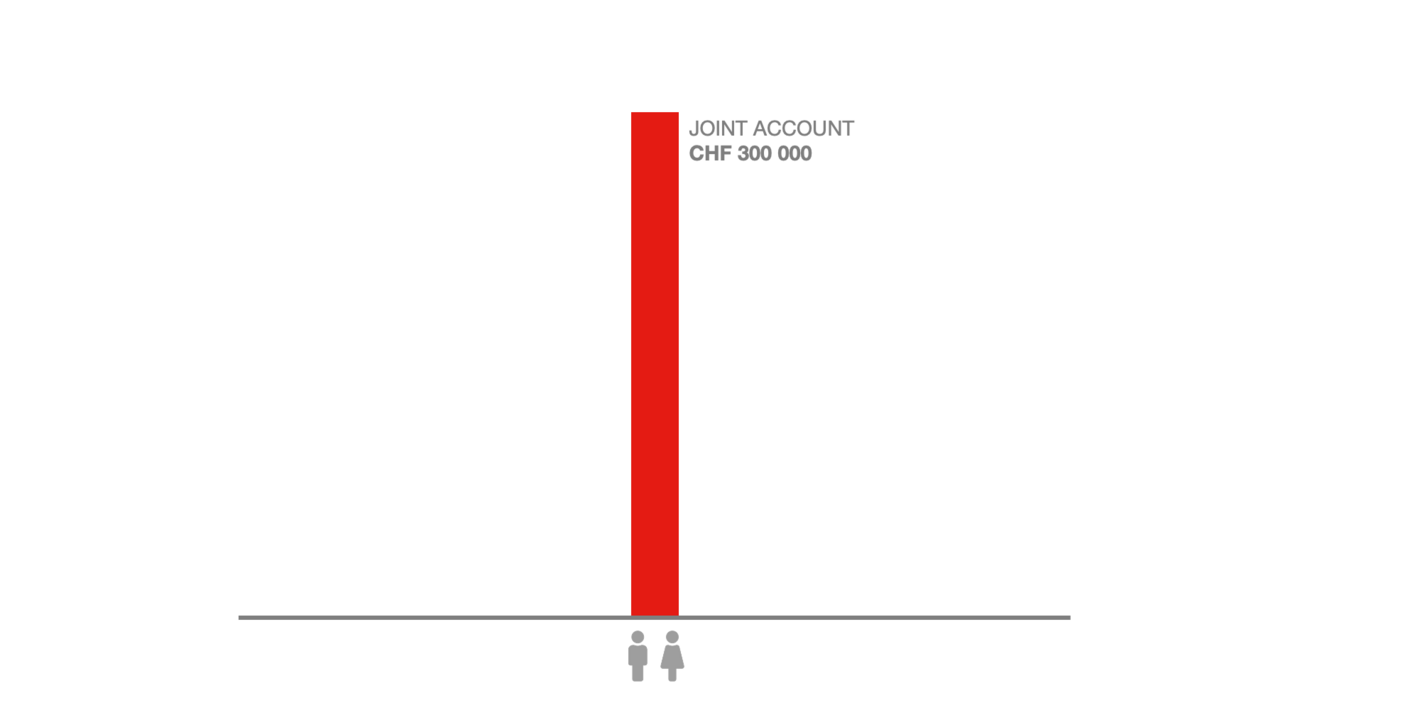

The spouses have a joint account with a balance of CHF 300 000.

The wife has her own account with CHF 100 000 and the husband also has his own account with CHF 100 000.

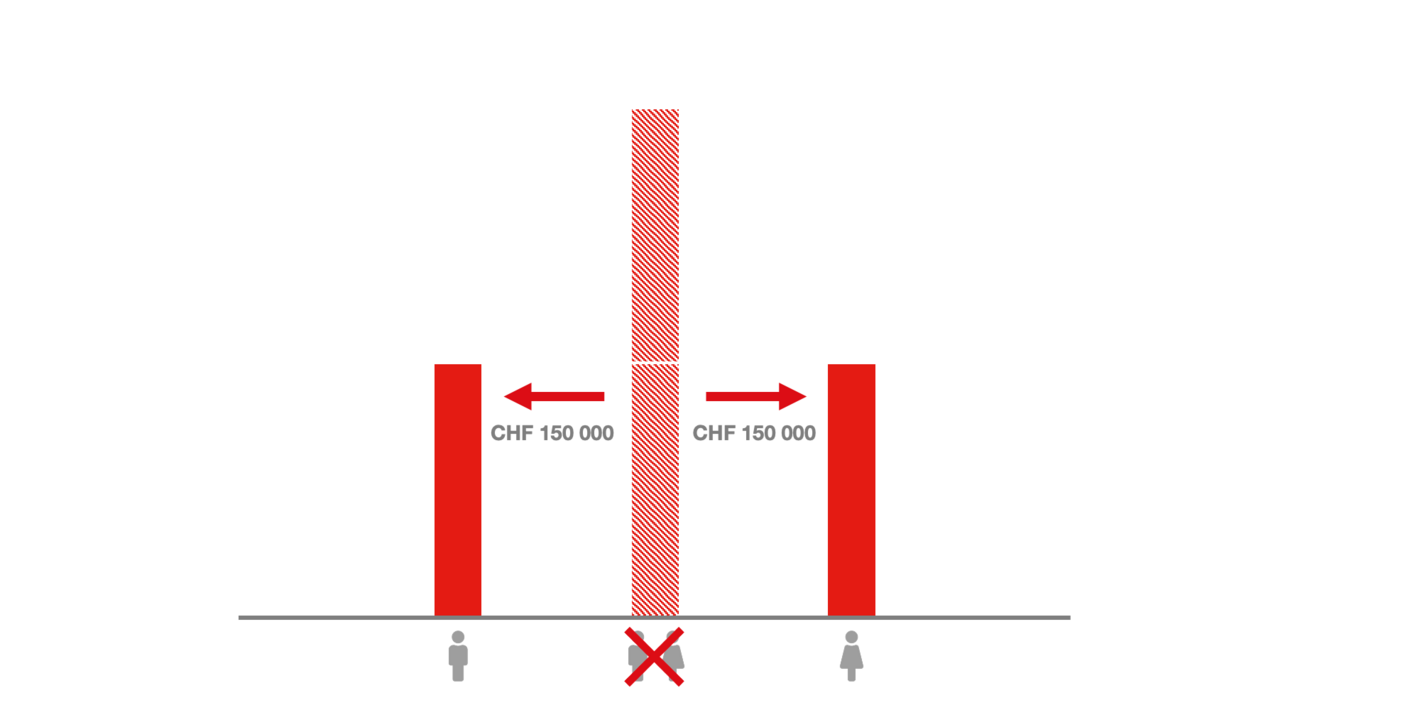

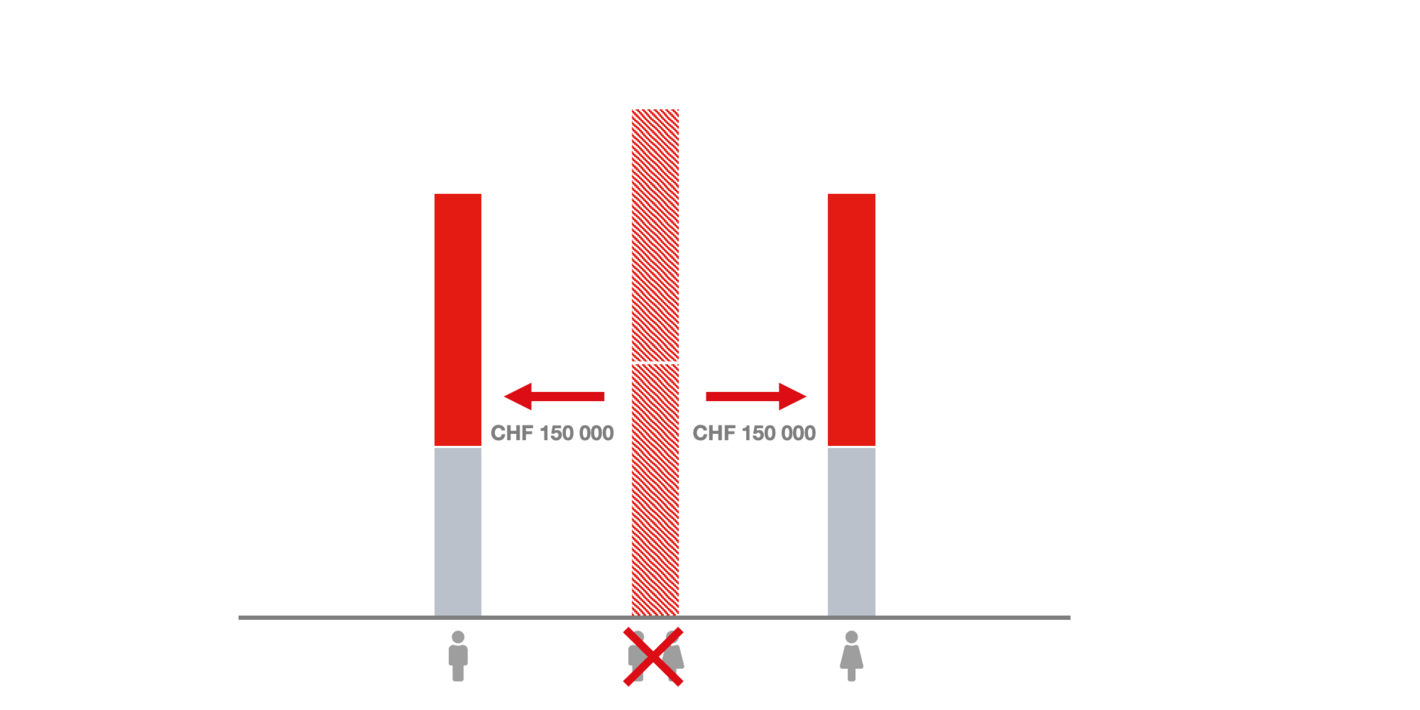

Until 31.12.2022: division of the joint account

In the past, the balance on the joint account was divided equally between the two spouses to determine the amount of the protected deposit. The community had no claim of its own. In this example, the balance of the joint account was divided between the husband and wife at CHF 150 000 each.

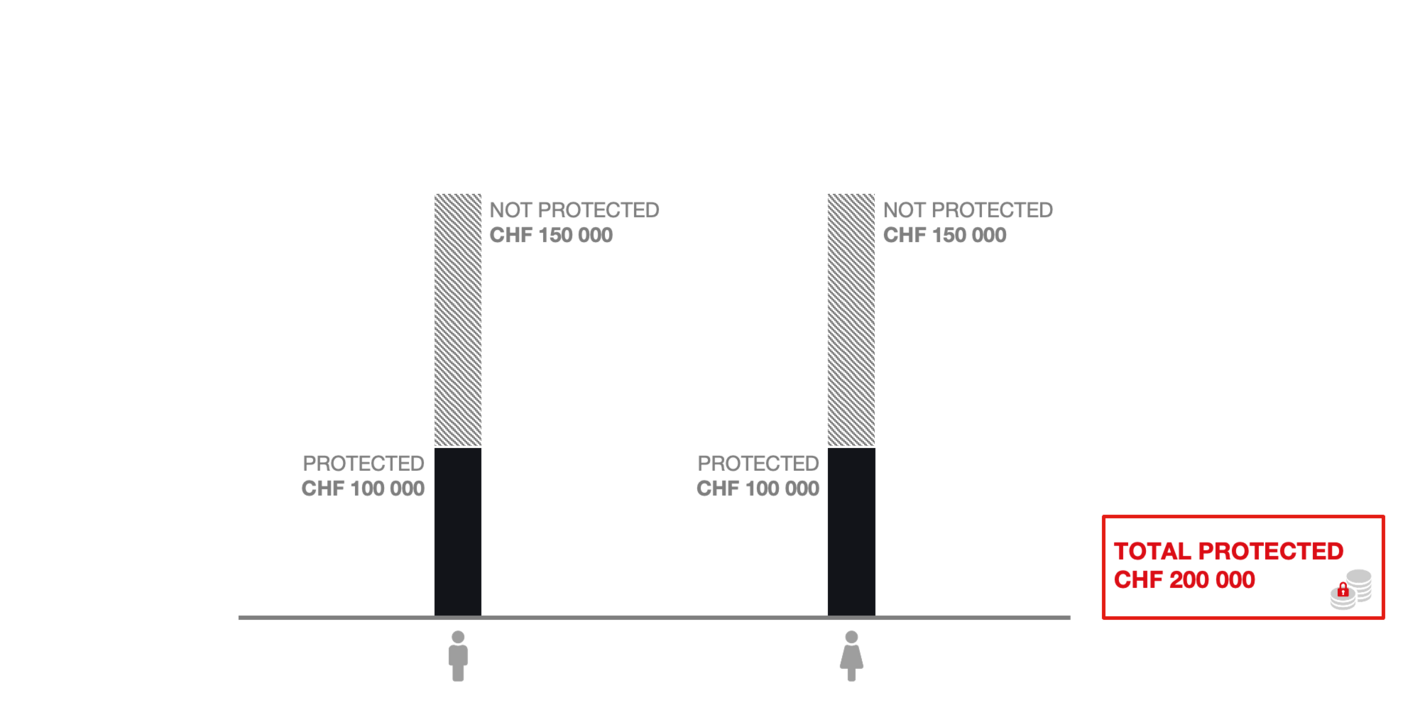

Until 31.12.2022: guarantee of deposits in the event of a bank’s bankruptcy

Afterwards, the divided amount was added to the balance of the own personal account. Finally, this sum was each limited to the protected amount of a maximum of CHF 100 000 per person. The spouses had protected deposits of CHF 200 000 in total from their personal accounts and the joint account.

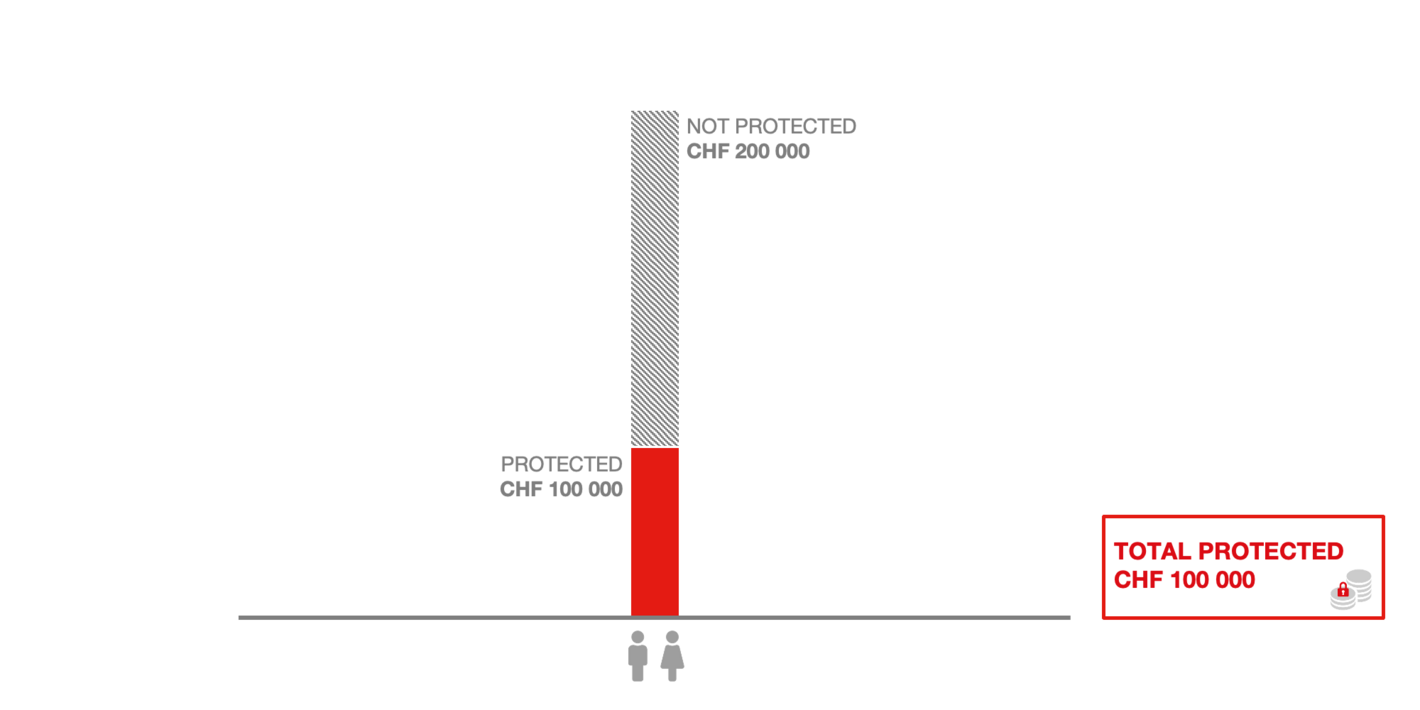

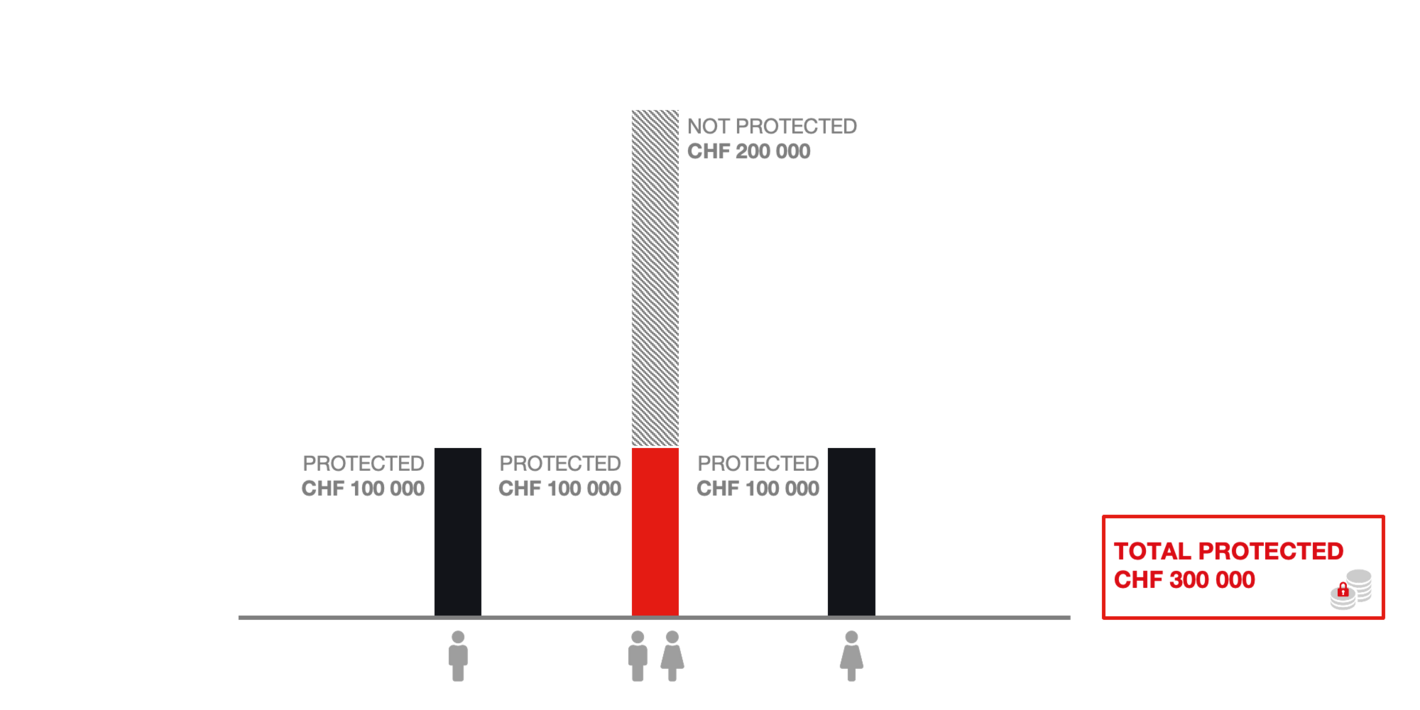

As of 01.01.2023: guarantee of deposits in the event of a bank’s bankruptcy

As of 1 January 2023, the spouses now form a community that has its own claim. The deposits of the community are protected up to CHF 100 000. In our example, the spouses therefore have protected deposits of CHF 300 000 in total.

What changes in the funding of the deposit insurance?

Collateral deposited

All banks in Switzerland are already legally obliged to hold liquidity in case they are required to pay to the deposit insurance scheme.

- As of 01.01.2023 they are required to deposit 50% of this payment obligation with a third-party custodian in advance in the form of securities or money. The remaining 50% is still subject to the liquidity requirements applicable to banks.

Contributions of the banks increased

The payment obligations for all banks – currently CHF 6 billion – is being increased.

- As of 01.01.2023, the amount will increase to approximately CHF 7.9 billion. This amount corresponds to the value specified in the law of 1.6% of all protected deposits in Switzerland.

What changes in the payout to clients?

Acceleration

The liquidator first uses the bank’s available liquidity to pay out the protected deposits.

esisuisse must finance the payout of the protected deposits if the bank’s liquidity is insufficient to pay out the protected deposits.

- esisuisse has a statutory period of a maximum of twenty days in which to transfer the necessary funds to the liquidator.

As of 01.01.2023, the deadline is seven working days. - The amount of time required for the payout depends on the bank’s structures and the cooperation of the client. A duration of several weeks can be expected.

As of 01.01.2028: After the liquidator has received the client's payout instruction, the aim is to pay out within seven working days.

Financial intermediaries and clients at foreign branches

What is changing for financial intermediaries?

- «Financial intermediaries» are no longer protected (no protection and no privileged treatment of deposits in case of bankruptcy).

- As an example, these include other banks, securities firms and insurance providers.

- The list of these financial intermediaries can be found in Art. 42c para. 2 of the Banking Ordinance.

What is changing for clients at foreign branches?

- If a client has deposits at a foreign branch of the bank, they are considered to be an individual, separate client of this branch.

- Deposits booked in Switzerland and deposits booked in a foreign branch are no longer added together for protection purposes or for privileged treatment under bankruptcy law.

- Deposits that are booked in foreign branches will continue to have no protection but will receive privileged treatment under bankruptcy law for up to CHF 100 000

Until 31.12.2022 the following applies: if the client has protected deposits at a Swiss bank and preferential deposits booked at a foreign branch of this bank, the amount of the preferential deposits at the foreign branch is reduced by the amount of the protected deposits at the bank.

Webinars for banks and securities firms

The revision of the Banking Act (Bankengesetz – BankG) and the Banking Ordinance (Bankenverordnung – BankV) with regard to deposit protection, which will come into force on 1 January 2023, requires all banks and securities firms to take action.

We are organising a total of three webinars for banks and securities firms to provide an initial overview of the new legal requirements. We provide information on the key regulatory points, show what banks and securities firms have to implement and how customers are affected by the changes.