Overview of the Swiss system

The depositor protection system is designed to prevent banks from becoming bankrupt. If a bank were to become bankrupt, clients could lose at least part of their deposits.

Depositor protection

Depositor protection in Switzerland is made up of the following key elements:

- Regulation

legislators have laid down strict conditions that banks must meet in order to accept client deposits. For example, banks must hold sufficient capital and liquidity to be able to pay out their client deposits at any time. There are also rules about how banks must be organised. - Supervision

the Swiss Financial Market Supervisory Authority FINMA supervises banks on an ongoing basis to ensure that they comply with these strict rules. If a bank gets into financial difficulty, FINMA can order protective measures or restructuring measures to avert bankruptcy. - System stability

the Swiss National Bank (SNB) can take measures to maintain the stability of the financial system. - Deposit insurance

the deposit insurance scheme is activated if a bank nevertheless becomes bankrupt. In the event of a bank’s bankruptcy, the deposit insurance scheme protects client deposits against loss up to the amount of CHF 100 000.

Who or what is a depositor?

Depositors are clients who hold a credit balance in an account with a bank.

What is depositor protection?

The term ‘depositor protection’ encompasses all the elements that contribute to protecting clients of banks in Switzerland and thus strengthen the country’s stability as a financial centre.

What is desposit insurance?

Deposit insurance is one element of depositor protection in Switzerland. In the event of a bank’s bankruptcy, the deposit insurance scheme protects client deposits against loss up to the amount of CHF 100 000.

Deposit insurance

The deposit insurance scheme consists of the following key elements:

- All banks must hold collateral consisting of assets in Switzerland equivalent to 125% of the protected and preferential client deposits.

- Protected deposits have preferential status in the event of bankruptcy.

- The bank’s liquidator appointed by FINMA uses the bank’s available liquidity to pay out the protected deposits.

- esisuisse funds the payment for the protected deposits if the bank has insufficient liquidity available. The banks make a maximum of CHF 7.9 billion available to esisuisse for this purpose.

This amount corresponds to the value specified in the law of 1.6% of all protected deposits in Switzerland.

The banks must provide esisuisse with collateral (securities or money) for half of these approximately CHF 7.9 billion by 01.12.2023 at the latest.

What are deposits?

Deposits are client balances on accounts held at banks.

Who is classed as a client?

All clients (private and corporate) of banks are protected by deposit insurance scheme: Natural persons (adults, children) and legal entities.

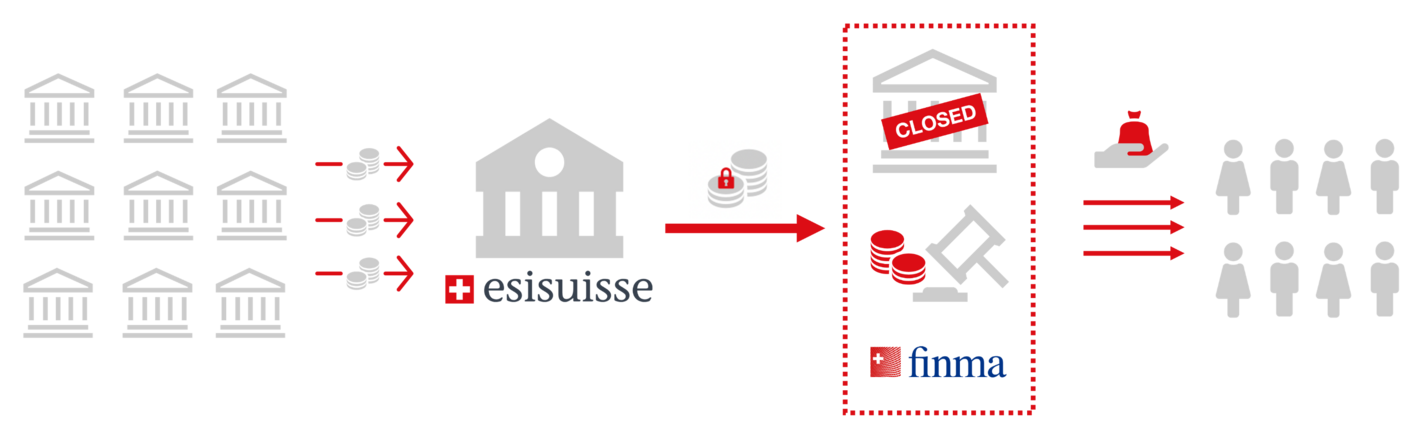

Bankruptcy of a bank

In the event of a bankruptcy, the banks are jointly and severally liable up to the amount of their payment obligation. esisuisse must finance the payout of the protected deposits if the bank’s liquidity is insufficient to pay out the protected deposits (deposit insurance call).

esisuisse transfers these funds to the liquidator, who can then pay out the protected deposits to clients.

The funds made available to esisuisse to bridge the liquidity gap will subsequently be returned by esisuisse to the member banks in the course of the liquidation of the affected bank as its assets are sold.

In order to ensure that the protected deposits can be paid out, each bank is required to hold additional collateral in the form of assets in Switzerland with a value of at least 125% of the total preferential deposits held with it (protected deposits up to CHF 100 000 plus preferential deposits at foreign branches of Swiss banks up to CHF 100 000 and preferential deposits up to CHF 100 000 in vested benefits or Pillar 3a accounts).

- The liquidator first uses the bank’s available liquidity to pay out the protected deposits.

- esisuisse must finance the payout of the protected deposits if the bank’s liquidity is insufficient.

- Only in this unlikely scenario does esisuisse make the necessary funds available to the liquidator.

- esisuisse may collect this additional money at any time from all other banks via direct debit.

- The liquidator pays out the protected deposits to the affected clients.

At a glance

- Protect the general public’s money against the risk of loss in the event of a bank’s bankruptcy

- Protected deposits are paid out

- Confidence in the Swiss financial system is strengthened

- Prevention and financial market stability: a bank run is prevented

- Private association with its registered office and office in Basel

- General Meeting of Members

- Board of Directors made up of independent members and bank representatives

- Executive Board

- Auditor

- It ensures that the bank’s bankruptcy liquidator has the necessary funds to be able to pay out the protected deposits to the affected clients

- It informs the public about the deposit insurance scheme, particularly in the event of a bank bankruptcy

- 257 members (as at 31 December 2023)

- Protected deposits: CHF 504 billion (as at 31 December 2022)

Are my pension assets also protected by esisuisse?

No, balances in vested benefits or Pillar 3a accounts are not covered by the deposit insurance scheme, but they are treated as preferential up to a maximum of CHF 100 000.

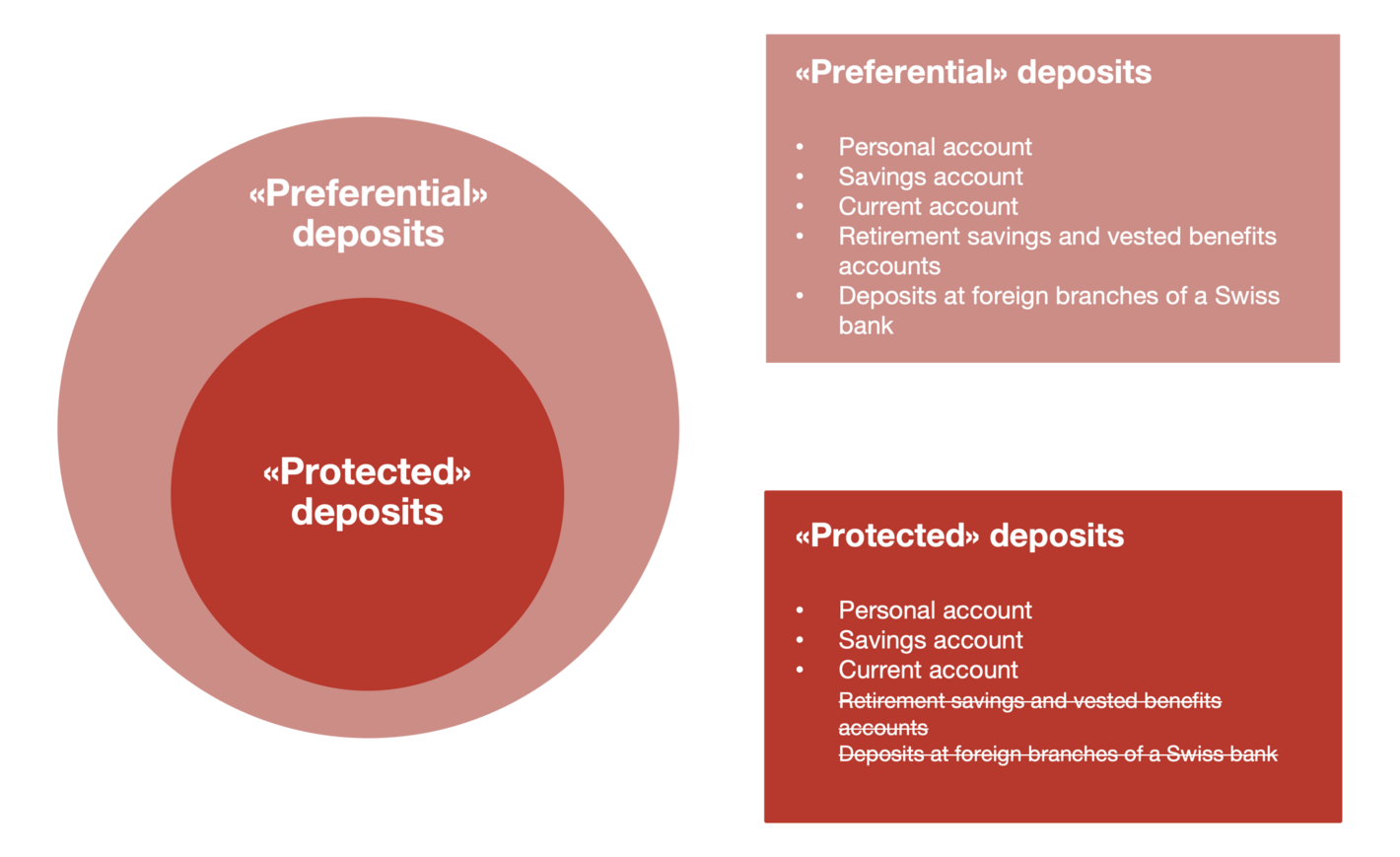

What is the difference between «preferential» deposits and «protected» deposits?

Preferential and protected do not mean the same thing. Preferential is primarily a question of bankruptcy law. It means that the deposits fall into the second creditor class rather than the third.

Protected deposits are a category of preferential deposits that have additional protection under the deposit insurance scheme, and that can be paid out.

Preferential deposits are not normally paid out until in the course of or at the end of the liquidation procedure.